As an entrepreneur, are you currently fed up with the intricate operations and invisible fees which come with classic consumer banking? The good news is, there’s a new participant in the industry that’s setting up a reputation for itself – Tide bank. By using a user-friendly foundation, cost-effective pricing, plus a concentrate on assisting little to method-sized enterprises tide business account do well, Tide bank is trembling the market. Let’s consider a closer inspection at what makes Tide bank various and good reasons to think about it for your organization financial demands.

1. User-Helpful System

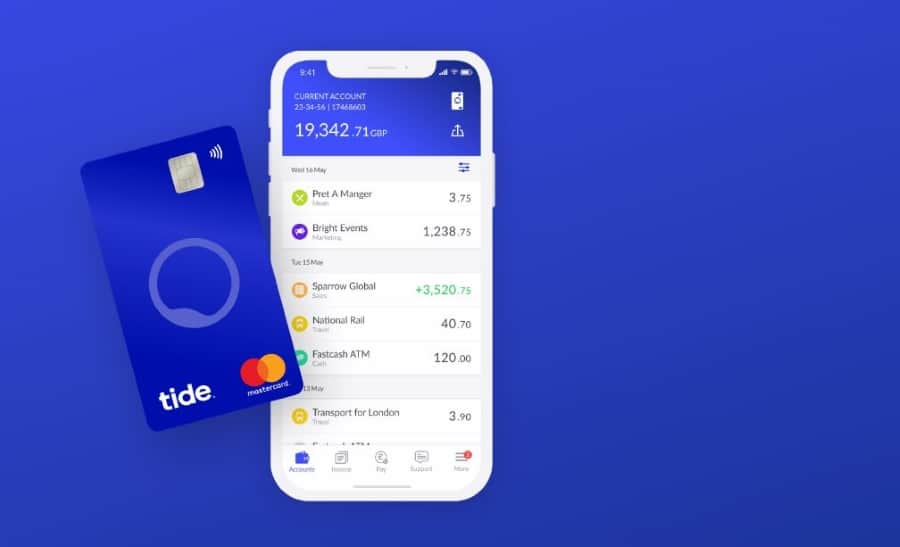

One of the primary offering factors of Tide bank is its effortless-to-use foundation. Bid farewell to clunky interfaces and complicated choices – Tide bank’s foundation is straightforward and simple. Regardless of whether you’re controlling your financial situation on pc or mobile, you’ll realize that moving Tide bank’s program is a breeze. As well as, the foundation is created specifically for small businesses, which means you’ll find all the tools you require in a practical place.

2. No Concealed Service fees

There is nothing far more annoying than being hit with unpredicted fees. With Tide bank, you’ll never need to bother about shock costs once again. Tide bank gives obvious prices, as well as its basic bank account is free to make use of. If you need additional features, like overseas payments or cash withdrawals, you may update to your paid for plan – but you’ll always determine what you’re investing in.

3. Enterprise-Targeted Features

Unlike classic financial institutions, Tide bank was created with small businesses in your mind. It means you’ll find lots of functions customized for your requirements, like invoicing equipment, cost managing, and automatic categorization of deals. Tide bank also provides integrations with preferred data processing computer software like Xero and QuickBooks, so handling your finances can be as effortless as you can.

4. Exceptional Customer Support

In terms of financial, you want to know available help if you want it. Tide bank provides high quality customer support, having a staff that’s accessible via stay talk, mobile phone, or e-mail. Additionally, Tide bank guarantees to respond to all queries within 2 hours – so you won’t be kept hanging around and asking yourself.

5. Dedication to Smaller Businesses

Probably the most important facet of Tide bank is its dedication to aiding smaller businesses flourish. Tide bank understands that small businesses would be the spine from the worldwide economy, and it’s focused on providing all of them with the instruments and assets they have to be successful. That’s why Tide bank has released many initiatives to assist small enterprises, including a COVID-19 hub that offers suggestions and resources to businesses afflicted with the pandemic.

To put it briefly

Simply speaking, Tide bank is a great choice for many small business owners who are searching for a consumer banking remedy that’s cost-effective, simple to use, and designed for their demands. With its adaptable prices, customer-pleasant system, and commitment to supporting small companies become successful, Tide bank is quickly transforming into a favorite among business owners and small businesses. So just why not try it out for yourself? We think you’ll be amazed by what Tide bank is offering.