A 1031 Exchange is a wonderful way to defer paying out taxes around the selling of an purchase house. However, there are actually rigid guidelines that must be followed to perform the swap. In this blog post, we will outline for you the 1031 Exchange Accommodator regulations and how to full the trade.

Exactly what is a 1031 Exchange?

A 1031 Exchange can be a income tax-deferred exchange of residence kept for investment or makes use of inside a industry or business. The exchange needs to be between like-form attributes and should be completed in just a a number of period of time.

The Benefits of a 1031 Exchange

There are several good things about finishing a 1031 Exchange. To begin with, it lets you defer spending income taxes on the purchase of the purchase residence. Additionally, it lets you reinvest the profits through the selling into an additional home without running into any capital gains taxes. Lastly, it gives you mobility with regards to what kind of home you can buy using the cash through the transaction.

The Health Risks of the 1031 Exchange

Additionally, there are numerous threats associated with completing a 1031 Exchange. To begin with, when the house you receive within the swap may be worth under the house you distributed, you should shell out taxation about the variation in benefit. Secondly, if you do not full the trade within the prescribed length of time, you will need to pay out taxation about the complete amount of the selling. Eventually, should you not follow all of the IRS policies related to 1031 Exchanges, you might be subject to fees and penalties and fascination expenses.

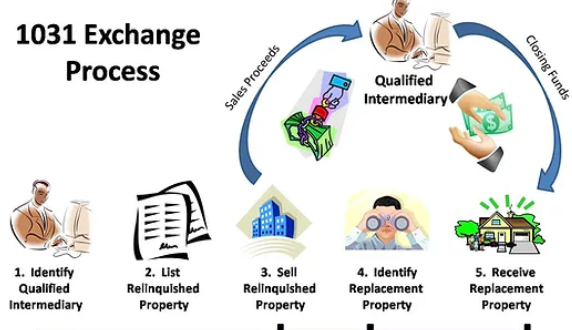

How You Can Finish a 1031 Exchange

To finish a 1031 Exchange, you need to initial determine the house that you would like to receive in the change. This property must be very similar by nature and benefit to the house offered. Once you have discovered the alternative house, you have to notify your certified intermediary of your objective to perform a 1031 Exchange within 45 events of promoting your original house.

You will then have 180 time from your date of promoting your authentic residence to close on your replacing house. It is essential to remember that you can not consider ownership of any of the cash from your purchase of your own authentic residence during this period—all earnings should be held by your certified intermediary until shutting down.

When you adopt these measures and finished your 1031 Exchange within the prescribed time frame, it is possible to defer having to pay taxation on the expense residence sale. However, you should meet with a taxation specialist before finishing any type of income tax-deferred change several regulations should be followed in order to avoid charges and curiosity charges.

Summary:

A 1031 Exchange could be a wonderful way to defer paying out income taxes by using an investment home transaction even so, there are actually stringent regulations that need to be put into practice for that it is finished properly. In this blog post, we certainly have defined a number of these guidelines and supplied useful guidelines on how to finish a 1031 Exchange. For those who have any queries or would like more information, you should contact us right now!